The 6F Blog: Financial Services

Welcome to the 6F Media Blog Financial Services category articles home page.

Streaming Data, Sharper Decisions: Real-Time Insight for Financial Advisors

Understood. Here is the rewritten October blog in the exact 6F Media financial services style and structure you specified.

Streaming Data, Sharper Decisions: Real-Time Insight for Financial Advisors

Markets never wait. Transaction patterns shift, client behavior changes, and new data streams in by the second. For advisory firms, reacting after the fact isn’t enough. The next edge lies in turning live data into real-time decisions.

AI-powered workflows now allow firms to capture and interpret that data instantly—helping advisors respond to events as they happen, not days later.

Turning Activity Into Action

Real-time analytics GPTs can detect behavior shifts the moment they occur—new deposits, sudden withdrawals, or portfolio rebalances—and generate quick internal summaries for advisors.

Instead of waiting on monthly reports, teams receive immediate insights and can guide clients through adjustments the same day.

Delivering Timely Client Communication

A Notification GPT can translate those same data signals into compliant client messages. When the market dips or rates change, firms can send concise, personalized updates within hours. Clients feel informed, not anxious, and advisors protect trust during volatility.

Building Smarter Campaigns

Marketing teams can feed streaming data into a Campaign GPT to identify trending interests across client segments. If younger investors start asking about ETFs or green portfolios, content can pivot instantly to match demand—keeping engagement high and messaging relevant.

Connecting Systems, Reducing Lag

Modern APIs now connect CRMs, analytics platforms, and marketing tools in real time. GPT workflows act as translators, ensuring every system sees the same picture without human handoffs or spreadsheet delays.

Why It Matters

Financial services thrive on timing and trust. When insights arrive faster, advisors make better calls, clients feel more confident, and firms strengthen their credibility.

Real-time intelligence is no longer a luxury—it’s the new baseline for advisory excellence.

Want to see how GPTs can help your firm move from delayed reports to real-time insight?

Contact 6F Media or schedule a 15-minute AI feasibility call to learn how our AI-Driven Marketing services can streamline your data and communication workflows.

How Financial Firms Can Stay Ahead of Market Shifts with AI Content

Markets move quickly. Interest rates rise, tax policies change, and global events ripple into portfolios overnight. Clients look to their advisors for perspective, but keeping pace with constant change is exhausting. Many firms fall behind, leaving clients to fill the gaps with headlines and speculation.

AI GPTs are giving financial services firms a way to stay in front of the conversation, offering timely insights without overwhelming staff.

Turning Market Events Into Client Updates

When big news breaks, speed matters. A Newsletter GPT can draft a professional summary, explaining what the change means for clients, in minutes. Compliance reviews the copy, and firms can distribute it the same day instead of a week later.

Building a Stream of Educational Content

A Blog GPT can convert advisor knowledge into ongoing posts on topics like inflation planning, estate strategies, or retirement income risks. Over time, these posts form a searchable library that positions the firm as a trusted source, not just a vendor.

Strengthening Social Visibility

Advisors who share consistent commentary build stronger digital reputations. A Social GPT can reshape blogs and newsletters into LinkedIn updates, giving firms a steady cadence of credible insights that clients and prospects notice.

Preparing Clients for What’s Next

AI research tools like Perplexity can surface trending questions and concerns, what people are asking about rates, taxes, or investments. Firms that use this data to tailor communication can address client concerns before they even reach the inbox.

Why It Matters

Financial trust is built on clarity and confidence. Firms that anticipate client questions and respond quickly stand out. With GPTs handling the drafting work, advisors can deliver that clarity without sacrificing client time.

Want to see how GPTs can help your firm stay ahead of market shifts? Contact 6F Media.

How Financial Advisors Use AI to Communicate More with Less Effort

Financial services depend on frequent touchpoints like market updates, planning reminders, quarterly reviews. The firms that communicate consistently are the ones that stay top of mind. The challenge is bandwidth: drafting newsletters, writing emails, and maintaining social feeds can consume hours that advisors would rather spend with clients.

GPTs are helping firms strike a balance, ensuring steady communication without creating extra workload.

Automating Routine Outreach

A Newsletter GPT can transform a few bullet points into a full client update in minutes. Instead of delaying communication until staff has time to draft, firms can keep updates flowing regularly, even during busy seasons.

Segmenting Without Extra Work

Different clients need different messages. Business owners may want tax updates, while retirees care more about income planning. An Email GPT can tailor drafts for each group based on templates, saving time while delivering personalized value.

Repurposing Across Platforms

Every insight an advisor shares can go further. A Blog GPT can create articles for the firm’s site, while a Social GPT reshapes that content into LinkedIn posts or client-facing notes. One idea fuels multiple channels.

Reducing Response Lag

Timely responses build confidence. GPTs can draft replies to common inquiries such as questions about contribution deadlines, meeting scheduling, or documentation requests, so staff can approve and send quickly. Clients feel supported, and advisors free up time.

Why This Matters for Growth

Scaling a financial advisory firm requires reaching more people without diluting service quality. Custom GPTs give firms the communication capacity of a larger team while keeping overhead in check.

Want to see how GPTs can help your firm communicate more consistently? Schedule a 15-Minute AI Feasibility Call.

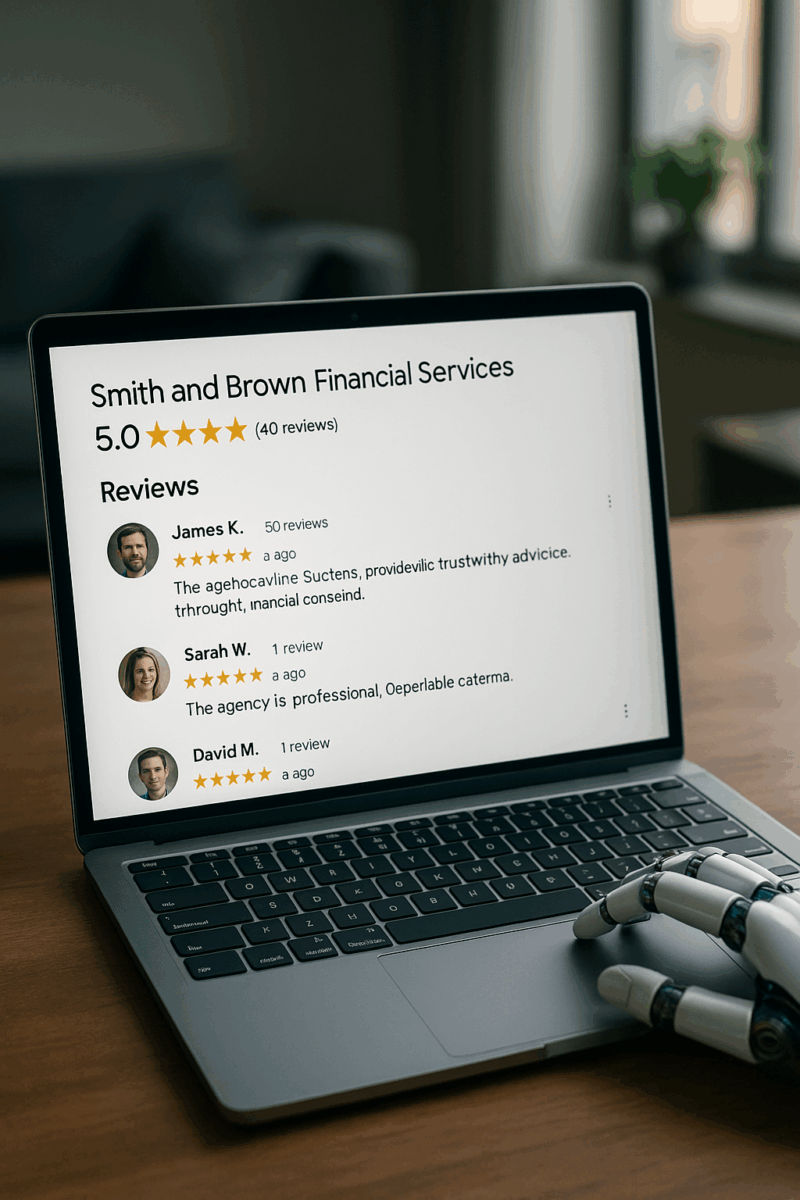

Building Trust Online with AI for Financial Services

Trust has always been the foundation of financial services. Traditionally, that trust was built face-to-face whether in the office, across the table, or through years of referrals. Today, much of that trust-building happens online before a client ever meets an advisor. The question becomes: how do firms project reliability and authority in a digital-first environment without overwhelming staff?

AI GPTs are emerging as one of the most effective tools to scale trust online, helping financial advisors maintain consistent communication while keeping focus on client needs.

Crafting a Professional Digital Presence

First impressions often come from a website or LinkedIn profile. A Blog GPT can help firms publish consistent, high-quality articles that explain complex topics, such as estate planning, tax law changes, investment basics in approachable language. Clients who see well-maintained content perceive the firm as organized, knowledgeable, and engaged.

Staying Present Through Timely Updates

Markets shift, rates move, and news breaks faster than advisors can realistically write. An Email GPT can turn advisor notes into polished updates, ensuring clients get timely insights. Even short reminders like IRA deadlines, quarterly reviews signal attentiveness and reinforce the advisor’s role as a proactive partner.

Encouraging Two-Way Dialogue

Trust grows when clients feel heard. GPTs can support structured communication systems: follow-up emails after meetings, satisfaction surveys, or personalized check-ins. By automating the draft stage, firms create more touchpoints without losing the human element.

Reinforcing Credibility on Social Platforms

LinkedIn and other platforms are crowded with advice and opinions. A Social GPT helps firms consistently post relevant content, such as case studies, industry commentary, educational snippets, positioning advisors as credible voices. Over time, that steady cadence builds familiarity and recognition.

The Long Game of Trust

Financial trust isn’t built in one meeting. It’s built in hundreds of small interactions that show competence and care. AI tools allow firms to maintain those interactions without stretching staff thin, ensuring every client feels guided and supported.

Want to explore how AI can help your firm strengthen client relationships online? Contact 6F Media.

Automating Outreach: How GPTs Free Financial Advisors to Focus on Clients

Financial advisors thrive when they’re in front of clients especially when explaining strategies, answering questions, and building trust. But too often, valuable hours are consumed by the mechanics of outreach: drafting newsletters, sending reminders, or preparing routine communications.

AI GPTs can carry much of that load, allowing firms to stay visible and responsive without sacrificing face time with clients.

Keeping Clients Informed Without the Grind

Markets move quickly. Clients want to know what rising rates, market dips, or tax changes mean for them. A Newsletter GPT can draft updates based on advisor bullet points or curated articles, producing professional copy that compliance can approve in minutes instead of days.

Personalized Reminders That Build Loyalty

Clients appreciate timely nudges: IRA contribution deadlines, quarterly check-in reminders, or year-end planning sessions. An Email GPT can generate personalized messages for different segments of your book, like business owners, retirees, young families, making outreach feel tailored rather than mass-produced.

Repurposing Content Across Channels

One strong blog post can fuel LinkedIn updates, short client notes, and even scripts for video explainers. A Social GPT ensures that a single idea gets maximum mileage, without staff rewriting the same message multiple times.

Protecting the Advisor’s Calendar

Every hour reclaimed from repetitive communication is an hour that can be spent on client planning, prospect meetings, or strategic growth. Over time, these small efficiencies compound into a stronger practice.

The Bigger Picture

Advisors who automate outreach with GPTs don’t just save time. They scale trust. They show up consistently, deliver useful insights, and stay top of mind with clients and prospects.

Want to see how a GPT suite could streamline your firm’s outreach? Contact 6F Media.

Beyond Spreadsheets: How AI GPTs Are Reshaping Marketing in Financial Services

Financial advisors and firms face a paradox. They handle markets that shift by the minute, yet their marketing often lags weeks behind. While clients are searching online for answers, many firms are still debating who will draft the next blog post or update the firm’s LinkedIn page.

AI, particularly specialized GPTs, is changing that dynamic. These tools don’t replace compliance review or client relationships, but they do remove the friction that slows firms down. The question isn’t if AI belongs in financial marketing. It’s where it creates the most leverage.

From Data to Storytelling

Markets are flooded with numbers, charts, and projections. Clients don’t want raw data. They want clarity. A Blog GPT can take advisor notes or daily market briefs and translate them into plain-language narratives: why a rate change matters, how a tax deadline impacts planning, or what volatility signals for long-term investors. Instead of chasing content after the fact, firms can lead the conversation.

Keeping a Pulse on Clients

Marketing is often treated as seasonal: a tax newsletter here, a year-end letter there. But clients now expect ongoing touchpoints. With an Email GPT, firms can schedule consistent updates: weekly, monthly, or even “breaking” notes after a market swing. The heavy lifting of tone, formatting, and drafting happens automatically, leaving advisors to approve the final send.

Staying Visible Without Noise

LinkedIn has become the front door for many financial firms. The challenge is producing professional content that signals expertise without sounding canned. A Social GPT can reshape blogs, white papers, or firm updates into short, digestible posts. The key benefit: advisors no longer need to choose between client meetings and building their digital presence.

What About Operations?

Marketing is only the start. Firms are also experimenting with GPTs for summarizing complex investment documents, drafting internal memos, and preparing billing notes. These operational add-ons aren’t flashy, but they chip away at the hidden admin costs that reduce client time.

The Competitive Edge

The firms that win in the next decade won’t just offer financial advice. They’ll communicate it better and faster than anyone else. AI GPTs give small and mid-sized firms the capacity once reserved for large institutions with entire marketing departments.

The question for financial services isn’t whether to adopt AI. It’s how quickly you’ll let it handle the tasks that slow your team down.

Want to see what a GPT suite could look like for your firm? Schedule a 15-Minute AI Feasibility Call.